Illustration: Felix Abt

The global environment faces a significant challenge and increased turbulence as the United States plans to cut off China’s oil supply from Iran. This bold move is part of Washington’s campaign to exert “maximum pressure” on the Iranian economy to impoverish the population and overthrow the government, including cutting off oil exports, which are a key pillar of the country’s economy and prosperity. It also aims to weaken the world’s largest and most energy-intensive industrial power, China, by hindering its access to affordable oil.

Countries affected by Washington’s economic war, such as Russia and especially Iran, have sold their oil to China at lower prices due to a lack of alternatives. European countries, on the other hand, have replaced cheap Russian energy with much more expensive energy, which has led to their de-industrialization and massively increased the competitiveness of Chinese industry vis-à-vis European industry. (Screenshot of a Reuters headline from October 11, 2023)

Scott Besson, head of the US Treasury Department in the Trump administration, has confirmed this commitment, aiming to reduce Iranian oil exports by over 90%.

The US empire determines on its own that Iran will no longer export 90% of its oil to impoverish the latter. (Bloomberg headline, February 14, 2025)

USA to provoke massive crisis by using its deadly hunger weapon

The implementation of these sanctions would likely lead to a catastrophic economic crisis in Iran, with the sanctions, America’s infamous hunger weapon, affecting millions of ordinary Iranians and also having a direct impact on China, the largest buyer of Iranian oil. The Chinese economy’s dependence on low-cost energy imports, particularly from Iran, exacerbates the situation. Additionally, the sanctions will likely drive up global oil prices, affecting not just China, but also the European Union and the United States.

China is by far Iran’s greatest oil customer (source: Kpler)

US to incite Iranian uprising, weaken China, and expand oil production

The U.S. seeks to achieve three main goals: 1) reducing Iran’s oil revenues to incite domestic uprising and regime change 2) undermining China’s industrial power, and 3) expanding its own oil production capacities. This strategy includes sanctions against the international network responsible for transporting Iranian oil to China.

The empire wants to extort high highwayman fees from ships

The US Trade Representative wants to implement a strategy that could impose the highest highwayman fees since the Middle Ages on unwelcome traders and shippers. The plan envisages collecting up to $1.5 million for every port call of a ship built in China. Chinese ship operators like Cosco could be forced to pay high fees of $1 million for every port call in the US, even if their ships were built outside of China. Non-Chinese operators of ships built in China, regardless of whether these ships dock in the US or not, are also to be massively ripped off.

Strategic Moves: Disrupting China’s Belt and Road Initiative

Washington’s broader strategy also targets China’s Belt and Road Initiative (BRI), which aims to disrupt China’s global investment, the development of emerging economies that trade with the Middle Kingdom, and Beijing’s global trade network. Tactics include creating chokepoints such as in Panama or the South China Sea, exerting diplomatic pressure and strengthening strategic alliances that threaten China.

No claim is nonsensical enough for the US empire to appropriate the Panama Canal. (headline The Independent)

This also encompasses a spectrum of tactics, from instilling fear through the false narrative of China ensnaring emerging economies in debt traps, to offering alternative infrastructure financing, and employing significant diplomatic pressure to dissuade countries from engaging with or withdrawing from BRI. In addition Washington is also imposing sanctions and and a range of restrictions on Chinese companies.

The “China debt trap” propaganda debunked (Headline The Atlantic)

Chinese resilience: economic aggression and historical parallels

The escalating hostility of both the Biden and Trump administrations has drawn stark parallels for the Chinese people, evoking memories of the dark times when Western powers and their current Japanese allies invaded, plundered and inflicted great suffering on the country.

After a century of humiliation at the hands of Western powers ravaging China with Opium Wars, and Western aggressors raging in Beijing’s summer palace in the manner of the Islamic State (ISIS) when China’s leadership was weak, the country is showing strength and determination this time as it no longer wants to accept being humiliated by its toxic opponents.

China has begun to respond to economic aggression, and this American escalation will not go unanswered.

The bullied one is determined to strike back at the Big Bully. (Bloomberg headline, 15 th February 2025)

The military encirclement of China by the United States is also escalating. Although China does not have a single military base near the United States, Washington speaks of the “Chinese threat” of all things, projecting only its own [source: caitlinjohnstone.com]

US Dollar dominance: economic benefits and global influence

The highly antagonistic stance towards Iran could lead to significant repercussions, particularly if the US targets Chinese banks or refineries, triggering a strong reaction from Beijing.

Washington’s strategy also aims to maintain the US dollar’s dominance as the leading global reserve currency, countering the shift towards national currencies by countries like China, Russia and Iran. The US wants to maintain the dominance of the US dollar at all costs, as it offers economic benefits (at the expense of other countries), trade advantages, geopolitical influence through its weaponization and seigniorage. This strategy also ensures continued demand for the dollar and strengthens its position in global trade (which does not reflect its weakened economy), particularly within the petro-dollar system.

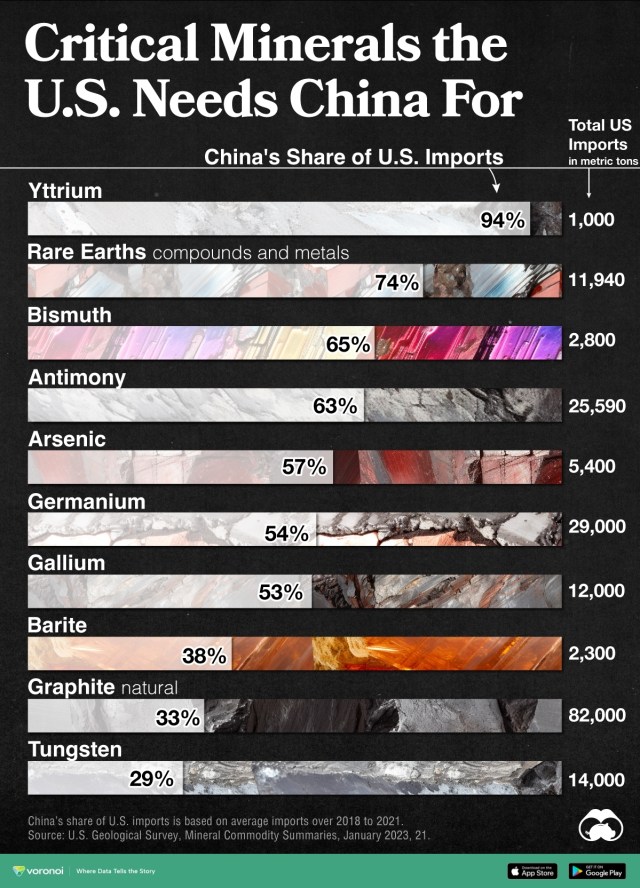

China now has an impressive toolkit, including minerals essential to US military and civilian industries, to deter its aggressors and retaliate. “China Dominates the Supply of U.S. Critical Minerals List,” writes Critical Capitalist (Screenshot Critical Capitalist)

Summary: Geopolitical and economic implications of US economic warfare

In summary, US efforts to restrict China’s oil imports from Iran represent a complex strategy with significant geopolitical and economic implications. The strategy aims to exert “maximum pressure” on Iran to bring it down in the interest of Greater Israel, its ally, to weaken China – again – which will provoke it on a massive scale, and to desperately maintain US dominance in world markets. In addition, the retaliatory measures against Washington and the impact on global oil prices will exacerbate the situation, which could also have significant consequences and setbacks for the aggressor.

▪ ▪ ▪

Related articles:

China’s Economy is Developing Tremendous Strategic Strength Instead of Collapsing as the Western Media Falsely Claim

The Economic War Against China Turns Chinese Into Patriots

A New Peak of Disinformation: Financial Times Lies that Business is Collapsing in China

When the Chinese Prime Minister was Vietnamese: In the Meritocracy Invented by China, Everyone, Even Foreigners, Had Equal Opportunities.

China’s economy is now a staggering 22% bigger than America’s, but for differing reasons, neither nation wants to acknowledge this fact

In China, the Communist Party is saving capitalism.

How China solved its terrorism problem: Not like America’s “war on terrorism,” which killed and displaced millions and left a trail of destruction in its wake