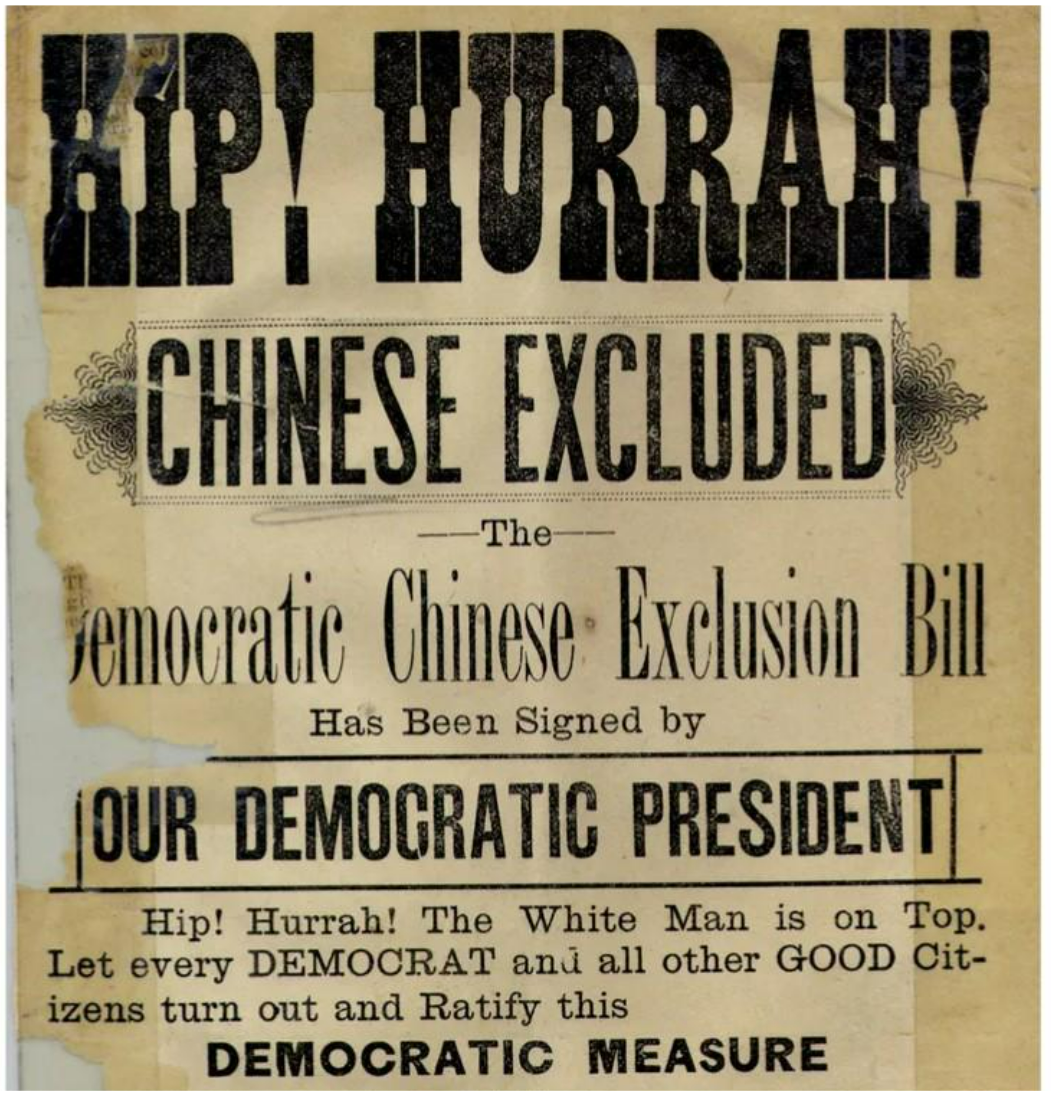

The Chinese Exclusion Act, enacted by white American supremacists, is barely mentioned in history classes in the United States. Will the current coercive policy against China and the thorough demonization of the country ever find its way into American history books?

One of China’s biggest economic problems is not the oft-predicted but erroneous collapse theory, it’s a completely different problem, a problem that surprises many and even shocks some. Much as the so-called experts would like to believe it will happen, China’s economy is not in any danger of collapse and one of the reasons is that they just have too much money; that’s correct, China has too much money and that’s a problem.

Chinese citizens busy counting notable savings

Having too much money isn’t the sort of thing that people would usually describe as problematic but what causes concern is that it isn’t being spent. During Covid it seems, Chinese people weren’t languishing in poverty worrying about their debts or how long their stimulus cheque would last, they were busy counting their savings all 17.8 trillion RMB ($2.6Tn) of it according to a People’s Bank of China report. Pandemics aside, Chinese people generally save about 20% of their income and, as a result, according to Larry Fink, CEO of Blackrock, China’s banks have accumulated assets of around $50 trillion US dollars.

China’s safety net

China’s GDP would be higher, consumption would be higher, economists in the west would be happier and CEOs of multinational corporations would be richer if China just went out and spent it, so why don’t they?

It’s a safety net issue; I talked in a previous article about poverty alleviation but little is known about China’s social security or welfare system. Based on the amount of misinformation about China, it’s easy to assume the country lives in some kind of economic state where people need to have a lot of money stashed away for emergencies but the facts of the matter are quite different.

Chinese people are naturally frugal, it’s one of their cultural dimensions and the reason is historical, Over millennia, they’ve needed to save for emergencies and retirement; in truth though, that need is diminishing.

From arduous, low-paying work to well-paying employment in a much better environment

Chinese working conditions are not, as some imagine, low paid sweatshops. They may appear to be hard working and uncomfortable factory lines but for many people, the alternative until recently, was backbreaking work in rural China on the family farm. However, workers in factories generally have excellent conditions, they often live in air conditioned dormitories and, if they get married, are provided apartments, most factories have canteens, employees are provided uniforms and get decent rates of pay applicable to local conditions – where an American factory worker might get an average of $16:41 which to a Chinese worker, seems a lot compared to their average of only 28 RMB ($4) but they pay no rent, have subsidized meals and are able to save 20-40% of that income, these are not the exceptions, these are the norms.

Westerners can’t understand why China is like it is until we understand where it came from. Forty-five years of Reform and Opening have taken China from an under-developed, impoverished society to the second largest economy in the world; that’s only one lifetime of an average worker.

Expensive medical treatment can no longer ruin a family.

In doing so, things Westerners, have always taken for granted needed to be introduced, and then accepted. A child growing up in a welfare state who gets sick, was taken to hospital and the welfare state would look after the child, in other places such as the USA, insurance would take care of the costs, they are different systems but developed to the point where everyone knew where they stood. In China the child becoming sick might have set the family back a year, or even a lifetime in savings depending on the severity of the illness. That’s all changed.

Furthermore, growing up in the West, we knew we would work until we were 65 and retire with a pension provided by our welfare state, a superannuation plan or both. In China, workers retire at 55 or at the latest 60 and were looked after by the family – in return, younger retirees would look after the babies while the middle-aged workers went out and earnt more money. Now, at least 15% of income is set aside for pensions.

The social systems that are being improved in China are being eroded in the West

In the West, some of these benefits are being eroded, it’s becoming harder to see a doctor in a welfare state and more expensive in an insured state. The opposite is happening in China.

Whilst it is very much still a work in progress, China’s social security system is all-encompassing. Every employed person in China now has medical insurance, makes pension contributions, has unemployment insurance, maternity insurance and workplace injury insurance. Employers must also provide a housing fund into which young people can make a contribution which is matched by the employer for the purchase of a first home.

Because these systems have been in place for less than one generation of workers, there is still some reluctance to rely on them. It’s also true that a generation of people retiring now did not get the benefit of 30 or 40 years of working in system that provides a full pension and so have saved during their working lives for retirement. For this reason, they have more in savings than people who have been able to rely on social welfare or superannuation coverage in their societies.

Also, because the system isn’t as developed as Western systems healthcare doesn’t always meet the needs it’s designed to meet. For example, in Beijing an employer contributes 10% of income to a medical fund and the employee pays 2%. But rather than act like an insurance, this system acts like a debit card. In the first year of an average income earner in Beijing might be 295k RMB. The medical card will have a balance of about 35,000RMB, if the employee has cancer after only working one year, then the hospital bill might be as much as 200,000RMB but the insurance will only pay what’s in the balance.

Hence the need to keep some savings in the family bank accounts.

However, if the employee retires after 30 years of working, and that insurance has not been utilized, it remains as medical coverage for the pensioner. Foreigners in China are not allowed to retain insurance so many will cash in and return to their homes with a healthy bonus, some will remain in China with enough funds from the cash-in to “self-insure” all but the most serious of medical events; adding to the savings pool.

There are also issues with pension inequality, some government jobs provide less salary but high pensions, some regional issues apply with investments in funds being different for different regions and therefore exposed to greater risks. These issues have been addressed by the NPC and new measures allowing for “Three Pillars of Personal Pension” were released in 2022 which allow for employees to opt for personal pension plans as opposed to the standard government issued.

The three pillars are a basic State pension, which every employee gets but, which the government recognizes, will fail to meet the needs of the ageing population; second is employer/employee contributed pension, introduced because of the issues with the first; and the third pillar is a new, private pension plan, offering huge opportunities to superannuation organizations that were unheard of and undreamed of just a few years ago.

We often forget when looking at China that until recent years, it was a third world country. The industrial revolutions in the UK, Europe and even the US created hellish conditions for the working classes: poverty; slavery and child labor; massive pollution; over-crowding, poor sanitation and incredibly dangerous working conditions, often with very young children going down mines or up chimneys. These conditions existed for hundreds of years until the Labor and Union Movements gained momentum which they are now losing.

The creation of the world’s largest middle class

China’s industrial revolution did indeed create pollution which has clearly been addressed with clean air and water throughout the country but, in every other respect, it did the opposite of Western countries. In less than 50 years since it began, China’s economic growth has created the world’s largest middle class, improved living conditions and better health outcomes for the working classes, Life-expectancy matches that of developed countries. China also legislated to protect children, although it is legal to work at 16, there are restrictions until 18 years of age. China also has an earlier retirement age with the current average retirement age being, according to the Economist, 54.

The opening paragraph of this article states that some people are shocked, here’s why: in 2022 Chinese people saved more money than the GDPs of all but 7 countries in the world, again, not an exception, this is just what is done in China!